Content

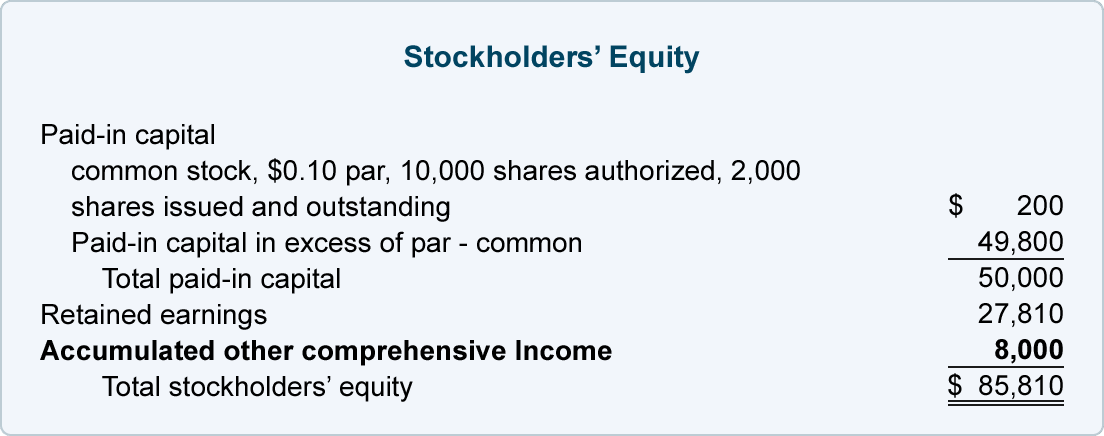

Each agrees to contribute $250,000 of capital to the formation of the joint venture, Joint venture XYZ , for 250 shares of stock, or 25% of the voting rights. Each company determines they will account for their investment using the equity method of accounting. For the purposes of this example, we will assume that cash is contributed, and there are not any basis differences at initial investment. Additionally, this investee has no OCI activities, therefore no OCI adjustments will be recorded. A corporation initially books the investment in another company’s shares as a noncurrent asset with a value equal to the purchase cost.

However, the amount is subsequently adjusted to account for your share of the company’s profits and losses. Rather, they are considered a return of investment, and reduce the listed value of your shares. Income is recognized by the investor immediately as it is earned by the investee. Thus, it cannot be reported again when a subsequent dividend is collected. Income must be recognized either when earned by the investee or when later distributed to the investor, but not at both times. Eventual payment of a dividend shrinks the size of the investee company. Thus, the investor decreases the investment account when a dividend is received if the equity method is applied.

Accounting for Investments – Equity Method, Including Consolidations

Understand the handling of dividends that are received when the equity method is applied and make the related journal entry. Learn Excel & VBA, accounting, valuation, financial modeling, and PowerPoint for investment banking and private equity – and save $194 with our most popular course bundle. The staff presented the first agenda paper on the Equity method of accounting research project. It was concluded that the scope should be narrow as a majority of the Board members did not see a problem with the equity method.

What is the equity method ACCA?

Under the equity method, just one line is recorded in the statement of profit or loss to represent the group's share of the results of the joint venture (or associate, which is given the same treatment). This is applied in entities where the parent company has either joint control or significant influence over another.

Under U.S. generally accepted accounting principles, an investor with a 20 percent to 50 percent stake in the voting stock of a company has substantial influence on the investee and uses the equity method of accounting. However, the Financial Accounting Standards Board interprets this rule flexibly. Interpretation No. 35 states that companies can overcome the presumption of substantial influence based upon the particular facts of the case. Thus, a company might be able to refute the claim of influence even if it owns 20 percent to 50 percent of investee shares.

Equity Method Investments and Joint

Let’s assume Bob’s Billiards buys 30% of Paul’s Pool Sticks outstanding stock for $50,000. Bob’s would debit the investment account and credit the cash account for the amount paid for the stock. If an equity method investee is considered significant to a registrant, the registrant may be required to provide the investee’s separate financial statements or summarized financial information in the financial https://online-accounting.net/ statement footnotes . None of the circumstances above are necessarily determinative with respect to whether the investor is able or unable to exercise significant influence over the investee’s operating and financial policies. Rather, the investor should evaluate all facts and circumstances related to the investment when assessing whether the investor has the ability to exercise significant influence.

- At the end of the year, Zombie Corp reports a net income of $100,000 and a dividend of $50,000 to its shareholders.

- The equity method treats an investment another company almost like an expansion or merger of the two companies.

- For example, if the investor owns 30 percent of the voting shares of a corporation that announces $1 million in net income, the investor increases, or debits, the asset for $300,000.

- On October 27, 2022, the FASB issued a proposed ASU on business formations.

- Unfortunately, the precise point at which one company gains that ability is impossible to ascertain.

Is performing poorly, yet the subsidiary company tends to provide exceptional brilliant performance even at times of turmoil. Thus equity accounting tends to accurately reflect this by segregating the amount that can be attributed to the amount earned from the subsidiary. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . Subsidiary CompanyA subsidiary company is controlled by another company, better known as a parent or holding company. The control is exerted through ownership of more than 50% of the voting stock of the subsidiary. Fund Accounting software solution meaningfully streamlines workflows like the equity pickup process and equity method accounting. Our platform eliminates the need to manually key in GL entries for each entity during a financial close, saving teams a significant amount of time and reducing risk in the process.

Download Allvue’s 2022 ESG in Private Equity survey

So, the company is most likely classifying this investment as “Equity Securities,” which means that Realized and Unrealized Gains and Losses show up on the Income Statement. But if Parent Co. decreases its stake in Sub Co., there will almost always be a Realized Gain or Loss to record. You subtract this “Equity Investments” line item when calculating Enterprise Value because it counts as a non-core-business asset. Explain the flow of Net Income and Dividends when a Parent Company owns 20% or 30% of a Subsidiary Company. The regular update summary paper on the most recent IFRS Interpretations Committee meeting was discussed with the board.

Items recorded through OCI may include foreign currency translation adjustments, pension adjustments, or gains/losses on available-for-sale securities. This Interpretation clarifies the criteria for applying the equity method of accounting for investments of 50 percent or less of the voting stock of an investee enterprise . Opinion 18 includes presumptions, based on the investor’s percentage ownership, as to whether the investor has that ability, but those presumptions can be overcome by evidence to the contrary and do not override the need for judgment. The investor calculates their share of net income based on their proportionate share of common stock or capital. Adjustments to the equity investment from the investee’s net income or loss are recorded on the investor’s income statement in a single account and are made when the financial statements are available from the investee. Income adjustments increase the balance of the equity investment and loss adjustments decrease the balance of the equity investment. When applying the equity method of accounting, an investor should typically record its share of an investee’s earnings or losses on the basis of the percentage of the equity interest the investor owns.

An example of accounting for an investment using the equity method

The Daily Upside Newsletter Investment news and high-quality insights delivered straight to your inboxGet Started Investing You can do it. During the third year JV XYZ has net income of $300,000 and pays dividends totaling $200,000. That’s a separate and more complicated topic, so we’re going to focus on just the equity method here. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless. The authors and reviewers work in the sales, marketing, legal, and finance departments. All have in-depth knowledge and experience in various aspects of payment scheme technology and the operating rules applicable to each. The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand.

© 2023 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity.

Equity accounting, no doubt, stands as an excellent method to gauge and understand the returns and income that can be attributed to the subsidiaries What Is Equity Method of Accounting that the business owns or runs. The income can be attributed to the different affiliates the business owns, manages, and runs.

- The investment asset’s recoverability, or the amount of cash or earnings it will generate over its remaining life, is compared against the investor’s carrying value.

- When a question arises as to whether the ability to apply significant influence exists, the percentage of ownership can be used to provide an arbitrary standard.

- The equity method is an accounting technique used by a company to record the profits earned through its investment in another company.

- While acknowledging that the treatment was correct under the application of IFRS 11, the student rightly queried whether that was actually helpful.

- All investments in the stock of another company—where ownership is no more than 50 percent—must be accounted for in one of three ways depending on the degree of ownership and the intention of the investor.